Buying a home is a big deal. It is likely the biggest purchase you will make. Protecting it is just as important. But insurance is confusing.

There are so many numbers. There are difficult terms. It can give you a headache.

You might want to just pick the cheapest one. Please don’t do that. Cheap can cost you more later. You need to know what you are buying.

That is why we are here.

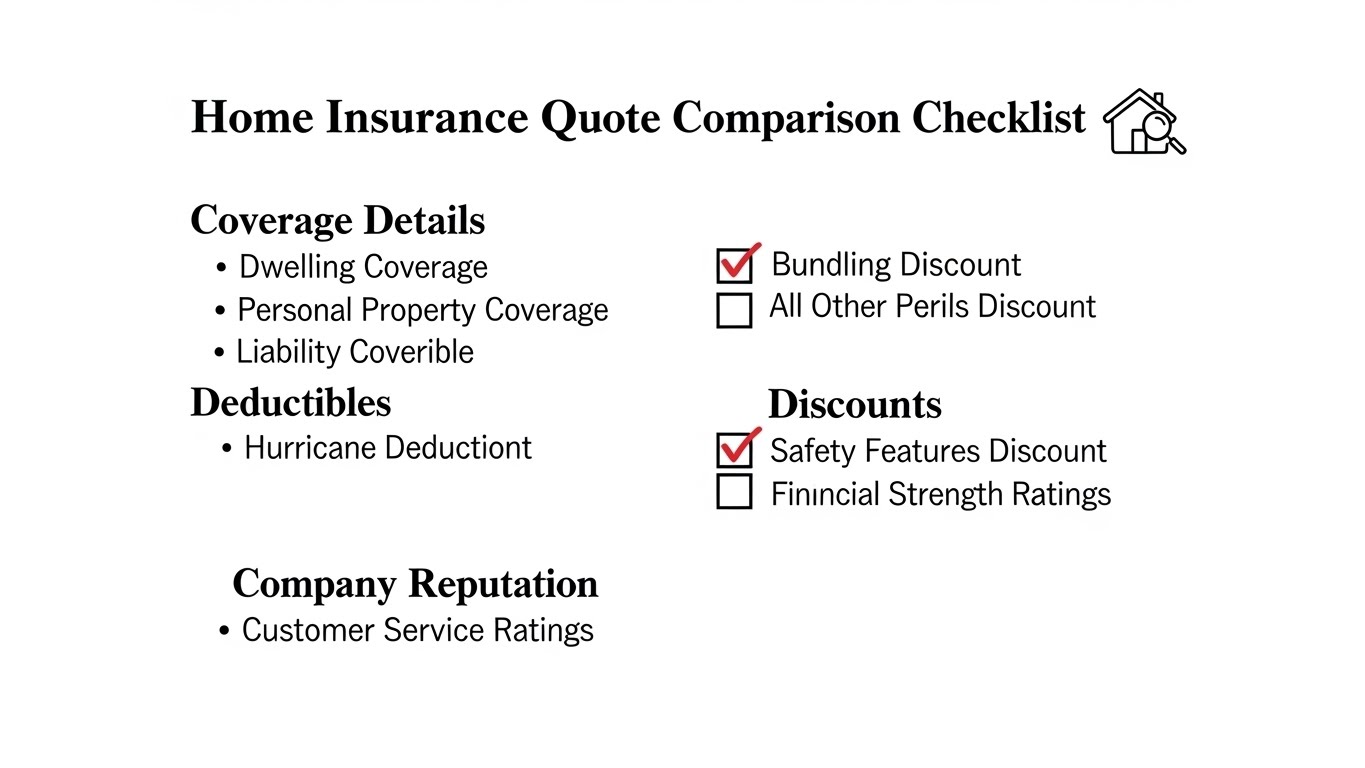

We have built a detailed Home Insurance Quote Comparison Checklist. This guide helps you compare apples to apples.

We will walk you through it. We will keep it simple. You will feel confident. You will save money. Let’s get started.

Why You Need to Compare Quotes

You might ask, “Why bother?”

Insurance rates change often. One company might love your area. Another might hate it. Prices can vary by hundreds of dollars.

You work hard for your money. You shouldn’t throw it away.

Comparing quotes gives you power. You see the market clearly. You find the best deal. You get the right coverage.

It is not just about price. It is about value.

“Price is what you pay. Value is what you get.” – Warren Buffett

We want you to get value. You deserve peace of mind. A good policy gives you that.

Phase 1: Gather Your Information

Before you call anyone, get ready. You need specific details.

Agents will ask many questions. If you have answers ready, it is faster. It is also more accurate.

If you guess, your quote will be wrong. Then the price will change later. That is frustrating.

Here is what you need to have in front of you.

The Basics of Your Home

- The address: Obviously.

- Year built: This matters a lot.

- Square footage: Be precise.

- Roof age: When was it last replaced?

- Heating system: Gas, oil, or electric?

- Plumbing updates: Have pipes been replaced?

Your Personal Details

- Date of birth: Rates vary by age.

- Social Security Number: They check credit scores.

- Claims history: Have you sued anyone?

- Current policy: What do you pay now?

This prepares you for the battle. Now, let’s look at the coverage.

Phase 2: Understanding the Core Coverages

This is the most important part of your Home Insurance Quote Comparison Checklist.

You must compare the same coverage limits. If Quote A has low limits, it looks cheaper. But it is not a better deal.

Let’s break down the main parts.

Coverage A: Dwelling Coverage

This pays to rebuild your house.

It is not the market value. It is the cost to rebuild. These are different numbers.

If your house burns down, you need to rebuild it. Labor costs money. Materials cost money.

Check this:

Does the quote cover 100% of replacement cost? Some offer 125%. This is better. It protects against inflation.

Coverage B: Other Structures

Do you have a detached garage? Do you have a fence? Or maybe a shed?

This covers those things. It is usually 10% of your Dwelling coverage.

Check if you need more. If you have a fancy barn, tell them.

Coverage C: Personal Property

This covers your stuff. Your clothes. Your furniture. Your TV.

Imagine taking your house and shaking it upside down. Everything that falls out is personal property.

There are two ways to insure this. This is critical.

- Actual Cash Value (ACV): They pay what it is worth now. An old TV is worth $50. You get $50. You cannot buy a new TV with that.

- Replacement Cost Value (RCV): They pay for a new one. You get enough for a brand new TV.

Our Advice: Always choose Replacement Cost. It costs a little more. But it saves you thousands later.

Coverage D: Loss of Use

If a fire happens, you can’t live there. You need a hotel. You need to eat out.

This pays for those extra costs.

Make sure the limit is high enough. Rebuilding takes time. It can take a year. You need rent money for that year.

Coverage E: Liability

This protects your bank account.

If someone slips on your ice, they might sue. If your dog bites a neighbor, they sue.

Liability pays for the lawyer. It pays for the settlement.

Recommendation:

Get at least $300,000. We prefer $500,000. It is cheap to add more. It protects your future wages.

Comparison Chart: Replacement vs. Actual Cash Value

We made this chart to show the difference. It shows why Replacement Cost wins.

| Item Damaged | Age of Item | Actual Cash Value Pays | Replacement Cost Pays |

|---|---|---|---|

| Leather Sofa | 5 Years | $200 (Depreciated) | $1,200 (New Sofa) |

| Laptop | 3 Years | $150 (Used Value) | $800 (New Model) |

| Roof | 15 Years | $3,000 (Old Roof) | $12,000 (New Roof) |

| Clothing | Various | $500 (Thrift Value) | $3,000 (New Clothes) |

Phase 3: The Deductible Factor

The deductible is what you pay first.

If you have a claim, you pay this amount. The insurance pays the rest.

A high deductible lowers your bill. A low deductible raises your bill.

Ask yourself:

Do you have $1,000 in the bank? If yes, raise your deductible to $1,000. It will save you money every month.

Some policies have percentage deductibles. This is common for wind or hail.

If your house is insured for $300,000. A 2% deductible is $6,000. That is a lot of money.

Check this carefully on your Home Insurance Quote Comparison Checklist.

Phase 4: Policy Endorsements (The Extras)

Basic policies have holes. You might need patches. These are called endorsements.

Look for these in your quotes.

Water Backup

This is huge. If your sewer backs up, it is gross. It ruins floors.

Standard policies do not cover this. You must add it. It is usually cheap.

Identity Theft

Some policies include this. It helps if your ID is stolen. It pays for restoration services.

Scheduled Personal Property

Do you have a diamond ring? Or expensive art?

Standard limits are low for jewelry. Maybe $1,500 total. If your ring is $5,000, you are short.

“Schedule” these items. This insures them for full value. It often covers “mysterious disappearance” too. Meaning, if you lose it, it is covered.

Phase 5: Discounts to Hunt For

You want the best price. Discounts are the key.

Every company offers different ones. You need to ask for them. Do not wait for them to offer.

Here is a grid of common discounts. Check if they are applied.

Discount Discovery Grid

| Discount Name | How to Get It | Estimated Savings |

|---|---|---|

| Multi-Policy | Bundle Home and Auto together. | 15% – 25% |

| Protective Devices | Install smoke detectors or alarms. | 2% – 5% |

| Claims Free | Have no claims for 3-5 years. | 10% – 15% |

| New Home Buyer | Buying a house recently. | Varies |

| Loyalty | Staying with one company. | 5% – 10% |

| Gated Community | Living in a secure area. | Small discount |

Tip: Ask the agent, “What other discounts do you have?” You might be surprised.

Phase 6: Evaluating the Company

Price is not everything. You need a good company.

If they don’t pay claims, they are useless. You need them to pick up the phone.

Check Financial Strength

You want a company with money. They need to pay out if a hurricane hits.

Look for an A.M. Best Rating. You want “A” or better.

You can check ratings at AM Best.

Check Customer Service

Read reviews. Do people hate them? Do they delay payments?

Look at the NAIC Complaint Index.

The National Association of Insurance Commissioners tracks complaints.

Visit the NAIC Consumer Site.

If the index is over 1.0, that is bad. It means they have more complaints than average.

Phase 7: The Final Checklist Walkthrough

Okay, you have your quotes. You have your data. Now we compare.

Lay the quotes side by side. Use this list.

- Is the Dwelling Coverage equal? Make sure they match.

- Is it Replacement Cost? Verify this for contents.

- Are the deductibles the same? Compare $1,000 to $1,000.

- Is Water Backup included? Look for the endorsement.

- Did they include all discounts? Double-check the bundle.

- How is the service rating? Did you check reviews?

If Quote A is $100 cheaper but lacks Water Backup, it is not cheaper. It is risky.

If Quote B costs more but has great service, it might be worth it.

Common Mistakes to Avoid

We see people make errors. These errors cost money.

Mistake 1: Under-insuring the House

Do not insure for market value. Market value includes land. The house does not burn down with the land.

Only insure the structure cost. But don’t go too low.

Mistake 2: Hiding the Dog

Do not lie about your dog. If you have a Pitbull, tell them.

If you lie and the dog bites, they deny the claim. You will be sued personally.

Mistake 3: Ignoring Floods

Home insurance does not cover floods. Rain coming through the roof? Yes. Rising water from a river? No.

You need a separate flood policy. FEMA manages this usually.

How to Switch Companies

You picked a winner. Great job!

Now you need to switch. It is easy.

- Buy the new policy. Set the start date.

- Notify your mortgage lender. They pay the bill usually. They need the new info.

- Cancel the old policy. Do this after the new one starts. Never have a gap.

- Get your refund. The old company owes you money back.

It is a simple process. Your agent can help you do it.

The Role of Credit Scores

This surprises many people. Your credit score affects your rate.

In most states, they use an “Insurance Score.” It predicts risk.

People with good credit file fewer claims. Statistics show this. So, they get better rates.

If your credit is low, shop around more. Some companies care less about credit than others.

Improve your score to lower your rate. Pay bills on time. It helps your insurance too.

Interpreting the “Fine Print”

Nobody likes reading contracts. But you should scan them.

Look for “Exclusions.” This is what they do not cover.

Common exclusions:

- Earthquakes (Need separate policy).

- Mold (Usually limited).

- Neglect (If you don’t fix a leak).

- Pests (Termites are on you).

Knowing this prevents shock later. You know what you are paying for.

Making the Decision

Take your time. Do not rush.

Review your Home Insurance Quote Comparison Checklist one last time.

Trust your gut feeling too. Did the agent explain things well? Did they treat you with respect?

You are entering a long relationship. You want a good partner.

If you are confused, ask again. A good agent loves to teach. A bad agent just wants a sale.

Comparison Feature Grid

Here is a quick way to visualize the features of a top-tier policy versus a basic one.

| Feature | Basic Policy (HO-3) | Premium Policy (HO-5) |

|---|---|---|

| Dwelling Coverage | Open Perils | Open Perils |

| Contents Coverage | Named Perils Only | Open Perils (Best) |

| Replacement Cost | Often Optional | Usually Included |

| High Value Items | Low Limits | Higher Limits |

| Ideal For | Older Homes / Budgets | Newer Homes / High Assets |

Note: “Open Perils” means everything is covered unless listed as excluded. “Named Perils” means only specific things (fire, wind) are covered.

Conclusion

You have done the work. You are ready.

Using a Home Insurance Quote Comparison Checklist is smart. It saves you money. It ensures you are safe.

Insurance protects your life. It protects your family. It protects your future.

Do not just buy a piece of paper. Buy a promise. A promise that they will help when things go wrong.

We hope this guide helped you. You are now an informed buyer. Go get that great deal!

Frequently Asked Questions (FAQs)

1. How many quotes should I get?

You should get at least three quotes. This gives you a good view of the market average.

2. Does checking quotes hurt my credit?

No. It is a “soft pull.” It does not lower your credit score at all.

3. Can I change insurance anytime?

Yes. You can switch any day of the year. You do not have to wait for renewal.

4. What is the best deductible amount?

For most people, $1,000 is best. It balances monthly savings with affordability during a claim.

5. Is flood insurance included?

No. Flood insurance is almost always a separate policy you must buy.

Disclaimer: This article is for informational purposes only. Insurance policies vary by state and company. Always read your specific policy documents.