Have you looked at your insurance bills lately? They can really hurt your wallet. You probably want to find a way to save. Most people suggest one common trick. You should bundle home and auto insurance together. It seems like the easiest way to save money.

But is it actually the best choice for you?

We are going to dig deep into this topic. I want to help you make the right decision. We will look at the good and the bad. You will learn how to shop smarter. Let’s figure this out together.

What Does Bundling Actually Mean?

Let’s start with the basics first.

Bundling is simply buying two policies from one company. You buy your car insurance from them. You also buy your home insurance from them.

In the insurance world, they call this a “multi-policy discount.”

The company loves this setup. It makes you a loyal customer. It makes you less likely to leave them. Because of this, they offer you a reward. That reward is usually a percentage off your bill.

It sounds like a win-win situation, right?

Usually, it is a good deal. But sometimes, it is a trap. You need to know the difference.

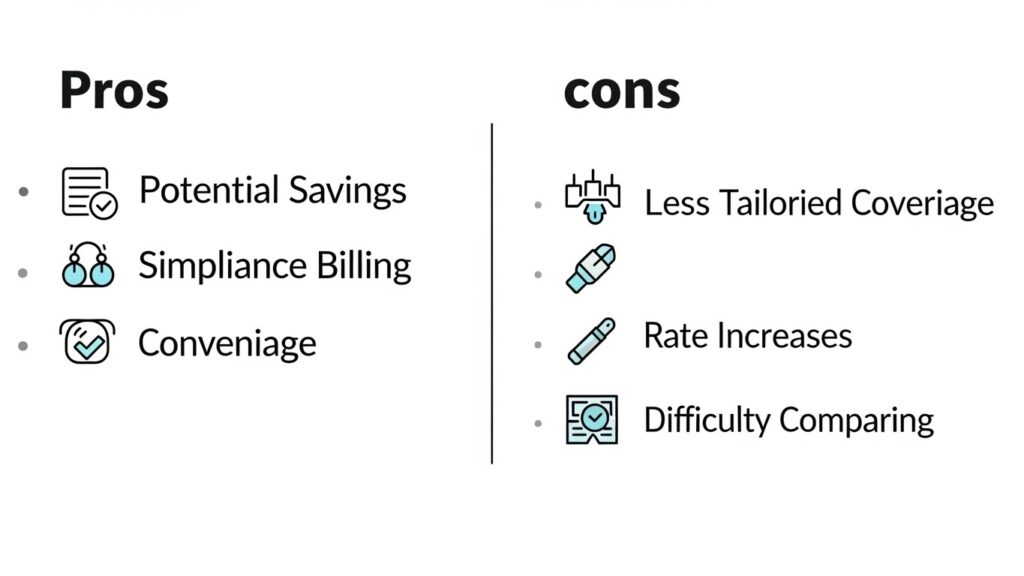

The Big Benefits of Bundling

Why do so many people choose to bundle? There are some very clear advantages.

1. The Financial Savings

This is the main reason we do it. Everyone wants to keep more cash.

Most companies offer a significant discount. You could save anywhere from 5% to 25%. That adds up to hundreds of dollars a year.

Imagine saving $300 just by making one phone call. That is real money in your pocket.

2. Serious Convenience

Managing life is hard enough. You have bills everywhere.

When you bundle, you simplify your life. You have one login for your account. You might even have just one bill to pay.

If you have questions, you call one agent. You don’t have to remember two different phone numbers. It saves you mental energy.

3. The Single Deductible Perk

This is a rare but amazing feature.

Some carriers offer a “single deductible” option.

Imagine a storm hits your house. A tree falls on your roof. That same tree hits your car in the driveway.

Usually, you pay a home deductible. Then you pay an auto deductible. That is expensive.

With some bundles, you only pay one deductible. It covers both items. This can save you a fortune during a disaster.

“The bitterness of poor quality remains long after the sweetness of low price is forgotten.” – Benjamin Franklin

Visualizing the Savings

Let’s look at the numbers. This table shows potential savings. These are estimates, but they show the power of bundling.

Table 1: Potential Bundling Discounts

| Insurance Carrier Type | Average Discount | Est. Yearly Savings |

|---|---|---|

| National Giants | 15% – 25% | $350 – $600 |

| Regional Carriers | 10% – 20% | $200 – $450 |

| Local Agencies | 5% – 15% | $100 – $300 |

Note: Savings depend on your credit and location.

When You Should NOT Bundle

I know the discounts look great. But bundling is not always the right move. Sometimes, keeping policies separate is smarter.

1. If You Are a High-Risk Driver

Do you have many speeding tickets? Have you had a DUI recently?

Your auto insurance will be very expensive. A bundled discount might not help enough.

You might find a specialized auto insurer. They focus on high-risk drivers. Their rate might be cheaper than a big carrier. Even without a bundle, the total cost could be lower.

2. If You Have a Unique Home

Do you live in a very old house? Do you live in a high-risk flood zone?

Some big auto insurers are bad at home insurance. They might charge you way too much for the house.

You might need a specialist for your home. Keeping the policies separate ensures better coverage.

3. Classic Car Owners

Do you own a vintage Mustang? Or maybe a restored truck?

Standard auto insurance doesn’t cover these well. You need “agreed value” coverage.

Specialty insurers like Hagerty do this best. They often don’t sell home insurance. So, you have to split your policies.

The “Price Creep” Danger

You need to watch out for this. It happens to loyal customers.

You sign up for a bundle today. The price is amazing. You feel great.

Two years pass. You don’t check your rates. The company slowly raises the price. They know you aren’t looking.

They count on your laziness.

This is called “price optimization.” They charge you more because you are unlikely to switch.

You must check your rates every two years. Don’t let them take advantage of you.

For more on how rates are determined, you can check the National Association of Insurance Commissioners (NAIC) for consumer guides.

How to Shop for a Bundle Like a Pro

You are ready to shop. How do you do it right? Follow these steps.

Step 1: Gather Your Data

You need your current policy pages. Look at your liability limits. Look at your deductibles.

You want to compare “apples to apples.” Don’t accept a lower price for worse coverage.

Step 2: Check the “Third Party” Issue

This is a tricky part.

Some car insurance companies don’t sell home insurance. They pay another company to do it for them. This is called an affiliate partner.

You might buy a policy from “Company A.” But the home policy is actually “Company B.”

This can be annoying. You might have two different logins. You might not get a single deductible. Always ask if the policy is “underwritten” by them.

Step 3: Get Three Quotes

Never stop at one quote. You need at least three.

- Check a large national carrier.

- Check a regional carrier.

- Check an independent broker.

An independent broker is helpful. They can check many companies at once for you.

Feature Grid: What to Look For

Use this grid when you talk to agents. Tick these boxes mentally.

Grid 1: The Perfect Bundle Checklist

| Feature | Why You Need It | Priority Level |

|---|---|---|

| Single Deductible | Saves money during big storms. | High |

| 12-Month Rate Lock | Keeps your price stable longer. | Medium |

| Accident Forgiveness | Keeps rates low after a crash. | High |

| Online Management | Easy access to ID cards/docs. | Low |

Does Your Credit Score Matter?

Yes, it matters a lot.

In most states, insurers check your credit. They use an “insurance credit score.”

If you have great credit, you get great rates. Bundling adds to those savings.

If your credit is poor, the bundle helps. It might offset the high base rate.

You should work on improving your score. It is the best way to lower costs.

Life Changes Affect Bundles

Life moves fast. Things change. Your insurance needs to change too.

Getting Married

This is the best time to bundle. Married couples get lower rates statistically. Combining two cars and a home saves a lot.

Buying a New Car

Always check the rate before you buy. Some cars are expensive to insure. It might ruin your bundle savings.

Moving States

Insurance laws change by state. Your current carrier might be expensive in the new state. You have to shop around again.

For reliable information on state-specific laws, the Insurance Information Institute (III) is a great resource.

A Chart of Customer Satisfaction

I cannot show you a real-time image. But I can show you a text chart. This represents how people feel about bundling.

Customer Satisfaction Ratings (Out of 10):

- Bundlers (Savings Focus): ⬛⬛⬛⬛⬛⬛⬛⬛⬛ (9/10)

- Bundlers (Claims Focus): ⬛⬛⬛⬛⬛⬛⬛⬜⬜ (7/10)

- Non-Bundlers: ⬛⬛⬛⬛⬛⬛⬜⬜⬜⬜ (6/10)

Analysis: People who bundle generally feel happier. This is mostly because of the price drop. However, claims handling depends on the specific company.

The Lazy Tax: Don’t Pay It

I mentioned this earlier. But it is worth repeating.

The “Lazy Tax” is real. It is the cost of doing nothing.

If you stay with one company for 10 years, you likely overpay. New customers often get better deals than old ones.

It is not fair. But it is how the business works.

You have the power to stop this. Set a reminder on your phone. Check rates every renewal period.

Common Myths About Bundling

Let’s bust some myths.

Myth 1: Bundling is always cheaper.

Fact: Not always. Sometimes two separate specialist companies are cheaper.

Myth 2: You lose coverage quality when you bundle.

Fact: Usually false. The policies are the same. You just get a discount.

Myth 3: It is hard to switch.

Fact: It is very easy. The new company does the work.

A Second Quote to Consider

“Price is what you pay. Value is what you get.” – Warren Buffett

Think about this. A cheap bundle with bad service is worthless. You need a company that pays claims fast.

Hidden Discounts You Might Miss

When you bundle, ask for more. You can stack discounts.

- Paperless Discount: Sign up for email bills.

- Pay in Full: Pay the whole year at once.

- Telematics: Use their app to track driving.

Stacking these on top of a bundle is huge. You could save 40% total.

Scenarios: Real Life Examples

Let’s look at two friends. This helps you see the reality.

Person A: John

John is 35. He owns a standard home. He drives a Honda Civic. He has good credit.

Verdict: John should bundle. He is the perfect candidate. He will save about $400.

Person B: Sarah

Sarah is 24. She rents an apartment. She drives a high-performance sports car. She has two speeding tickets.

Verdict: Sarah should shop separately. Her car insurance is too risky. A standard bundle might reject her. She needs a high-risk auto carrier.

The Final Verdict

So, should you bundle home and auto insurance?

For most people, the answer is YES.

If you own a standard home and car, do it. The savings are too good to ignore. The convenience is wonderful.

But you must be smart. Don’t just auto-renew forever. Keep an eye on your rates.

You work hard for your money. Don’t give it away to insurance companies unnecessarily. Take control of your policy today.

Frequently Asked Questions (FAQs)

Here are the most common questions I get.

1. Can I bundle if I rent my home?

Yes, absolutely. You can bundle renters insurance with auto insurance. It is very common.

2. Does bundling affect my credit score?

No. Checking quotes is a “soft pull.” It does not hurt your credit score.

3. Can I bundle motorcycle insurance too?

Yes. Most carriers let you add motorcycles, boats, or RVs to the bundle.

4. Is it hard to cancel my old insurance?

No. Your new agent will usually help you write the cancellation letter.

5. What if I move to a different state?

You can keep the same company if they operate there. But the price will change.

Disclaimer: I am an insurance writer, not a financial advisor. Insurance rates vary by person. Always read your policy documents carefully.